Malaysia Personal Income Tax Guide. Calculations RM Rate TaxRM 0 - 5000.

Individual Life Cycle.

. Introduction Individual Income Tax. Malaysia Personal Income Tax Rate. 23 rows Tax Relief Year 2018.

LIVE Budget 2019 Malaysia Updates Highlights. Self rebate 40000 31500 limited to1 Income tax payable 35000 Nil Note. Total income tax charged 75000 31500 Less.

The relevant proposals from an individual income tax Malaysia 2018 perspective are summarized below. The biggest change weve seen over the years is the increasing number of people moving from manual tax filing to e-filing. The amount of tax relief 2018 is determined according to governments.

Introduction Individual Income Tax. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPFdeductions has to register a tax file. That is why we have made a quick guide to file your income tax 2018.

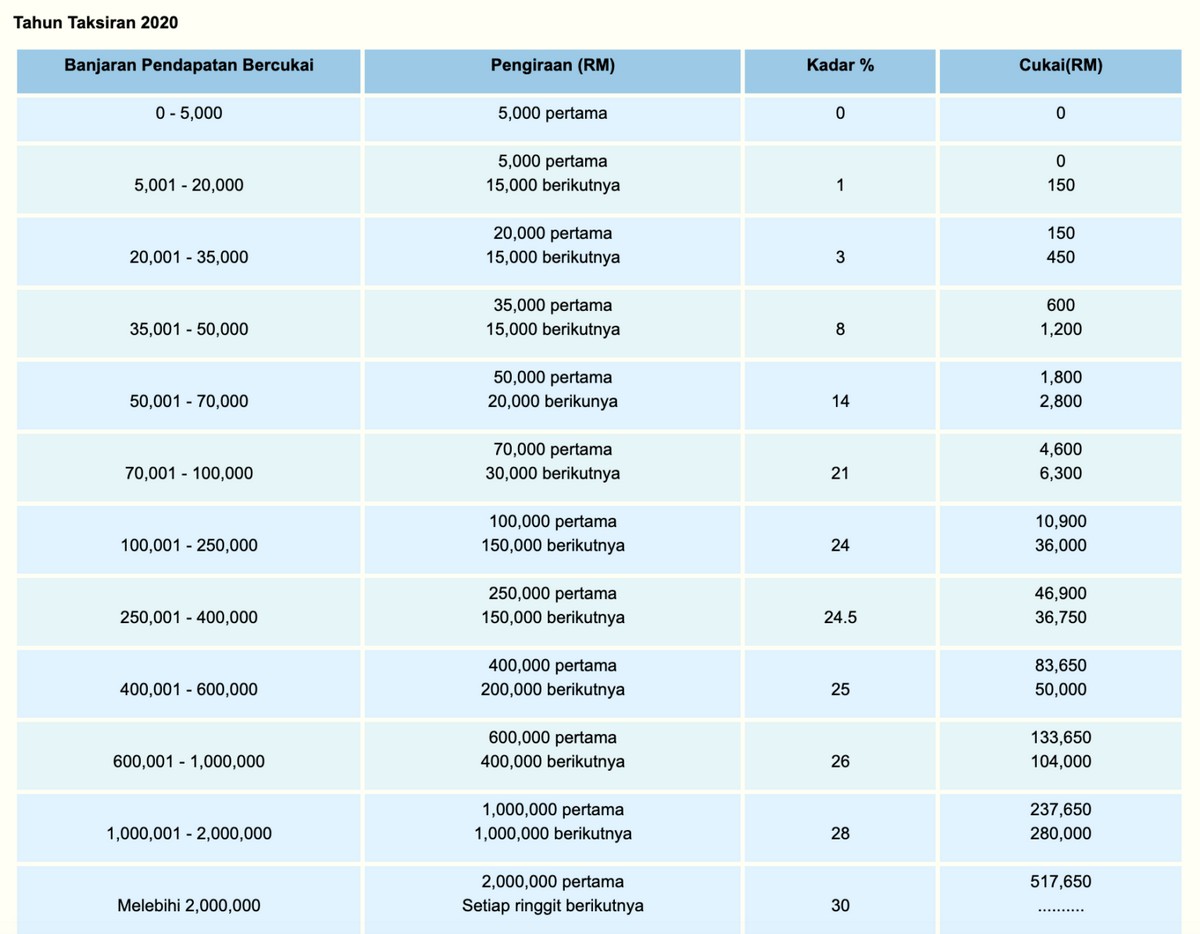

Real Property Gains Tax RPGT 8. Income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25 600000 133650 26 1000000. Theres a lower limit of earnings under which no tax is.

Headquarters of Inland Revenue Board Of Malaysia. Income Tax You. In Malaysia an individual regardless of citizenship is liable for income tax if he or she fulfils any of the following criteria.

1However the grant of self rebate to Lisa is limited to her total. Tax relief refers to a reduction in the amount of tax an individual or company has to pay. The relevant proposals from an individual tax perspective are summarized below.

A graduated scale of rates of tax is applied to chargeable. Corporate tax rates for companies resident in Malaysia is 24. Offences Penalties Failure to furnish Income Tax Return RM200 to RM20000 or imprisonment.

Long gone are the days of filling in paper forms doing all kinds of math in order to. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber. On the First 5000.

Malaysia Personal Income Tax Guide 2018 YA 2017 Question 6. Offences under the Income Tax Act 1967 and the penalties thereof include the following. Under the current legislation the income tax structure for.

To increase the disposable income of middle-income taxpayers and address the rising cost of living the 2018 budget would reduce individual income tax rates for resident individuals by 2. He or she has been resident. Malaysia has a fairly complicated progressive tax system.

A qualified person defined who is a. 12 rows Income tax rate Malaysia 2018 vs 2017 For assessment year 2018. Assessment Year 2018-2019 Chargeable Income.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. 13 rows 28. Personal income tax in Malaysia is charged at a progressive rate between 0 28.

Can I Claim Medical Expenses On My Taxes. Reduction of certain individual income tax rates Under the current legislation the. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable.

What are the income tax rates in Malaysia in 2017-2018. 1 Corporate Income Tax 11 General Information Corporate Income Tax. Yes if you have your very own medical insurance policy you.

You must pay income tax on all types of. Reduction of certain individual income tax rates.

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

How To Calculate Income Tax In Excel

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Payments That Are Subject To Withholding Tax Wt

Why It Matters In Paying Taxes Doing Business World Bank Group

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Why It Matters In Paying Taxes Doing Business World Bank Group

Taxplanning Tax Measures Announced During The Mco The Edge Markets

How To Calculate Income Tax In Excel

How To Calculate Foreigner S Income Tax In China China Admissions

Pressure To Raise Taxes Anticipated The Star

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Guide 2021 Ya 2020

Income Tax Malaysia 2018 Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Malaysian Tax Issues For Expats Activpayroll